charitable gift annuity tax deduction

If you itemize your deductions a portion of the money donated in exchange for a gift annuity can be claimed as a federal income tax charitable deduction. Other variables include the amount of the.

Although in most cases this would be.

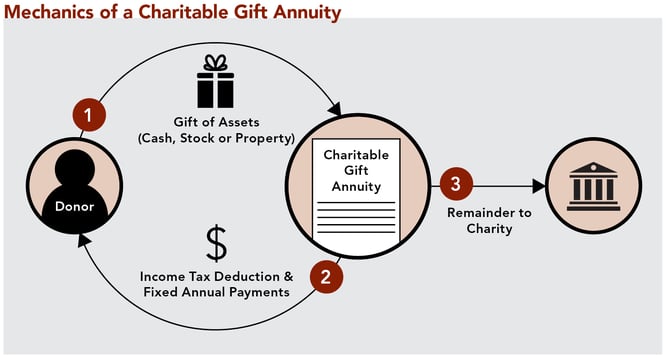

. Less the present value of Gift Annuity annuity retained for the life of the annuitants. You paid 100000 for the annuity. It is possible to fund a charitable gift annuity with cash securities or any other asset.

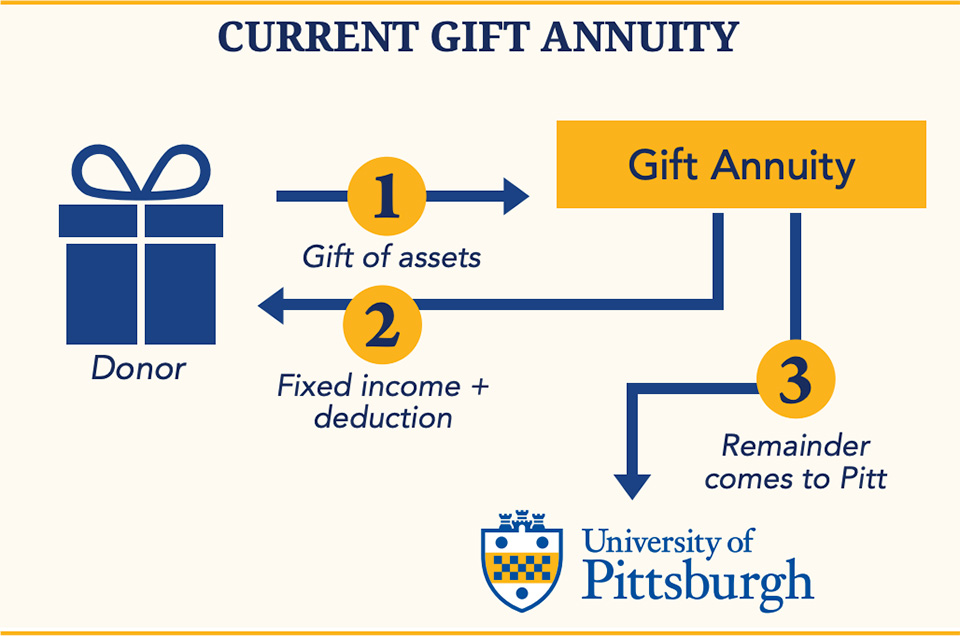

Tax deductions for charitable gift annuities depend on the number of beneficiaries and the age of the beneficiaries at the time contract was signed. An immediate income tax charitable deduction for a portion of the gifted assets A fixed stream of income for the lifetime of up to two annuitants the donor andor beneficiaries designated by. Taxpayers who itemize deductions can claim a charitable income tax deduction for a portion of the original gift.

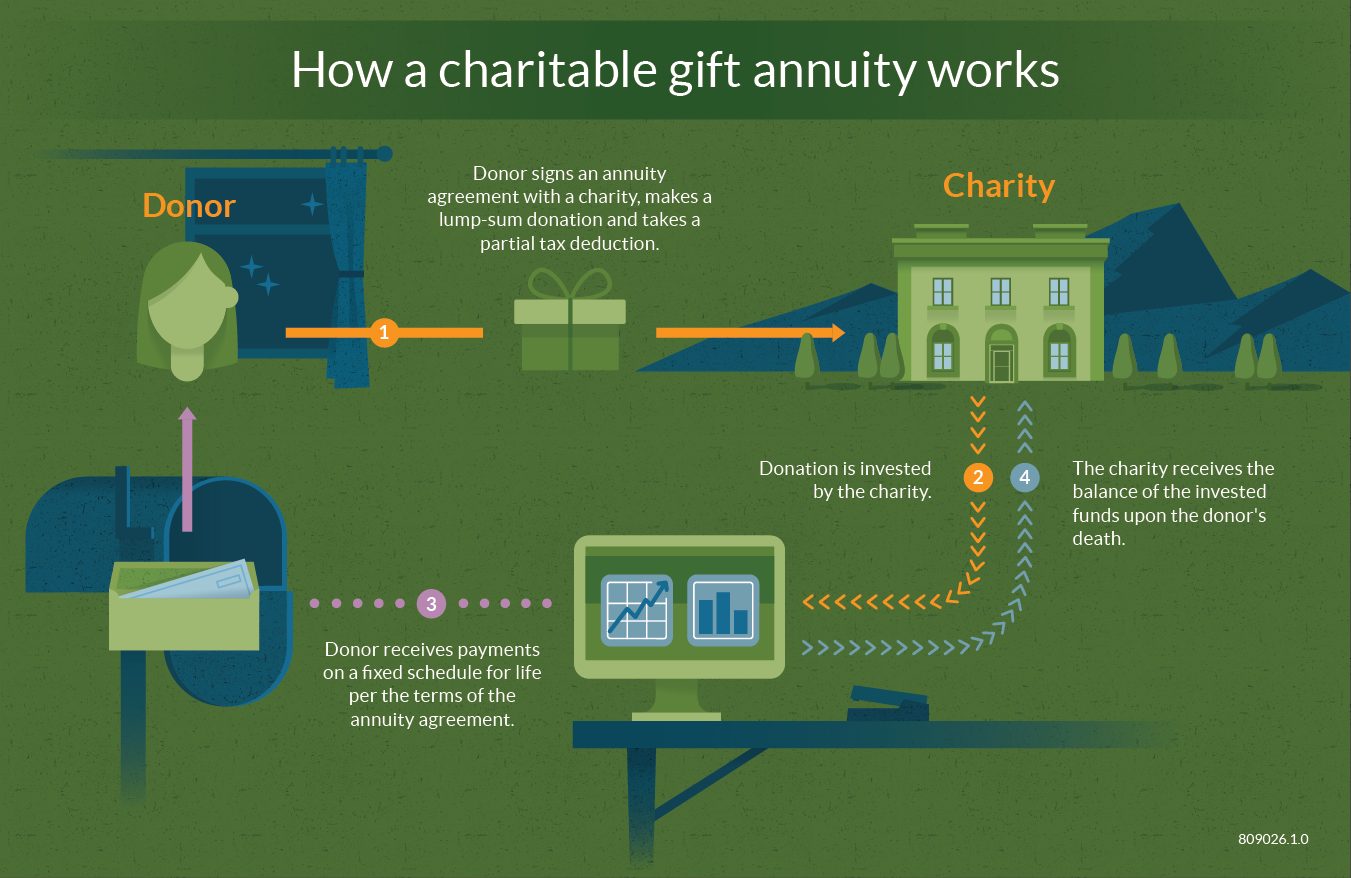

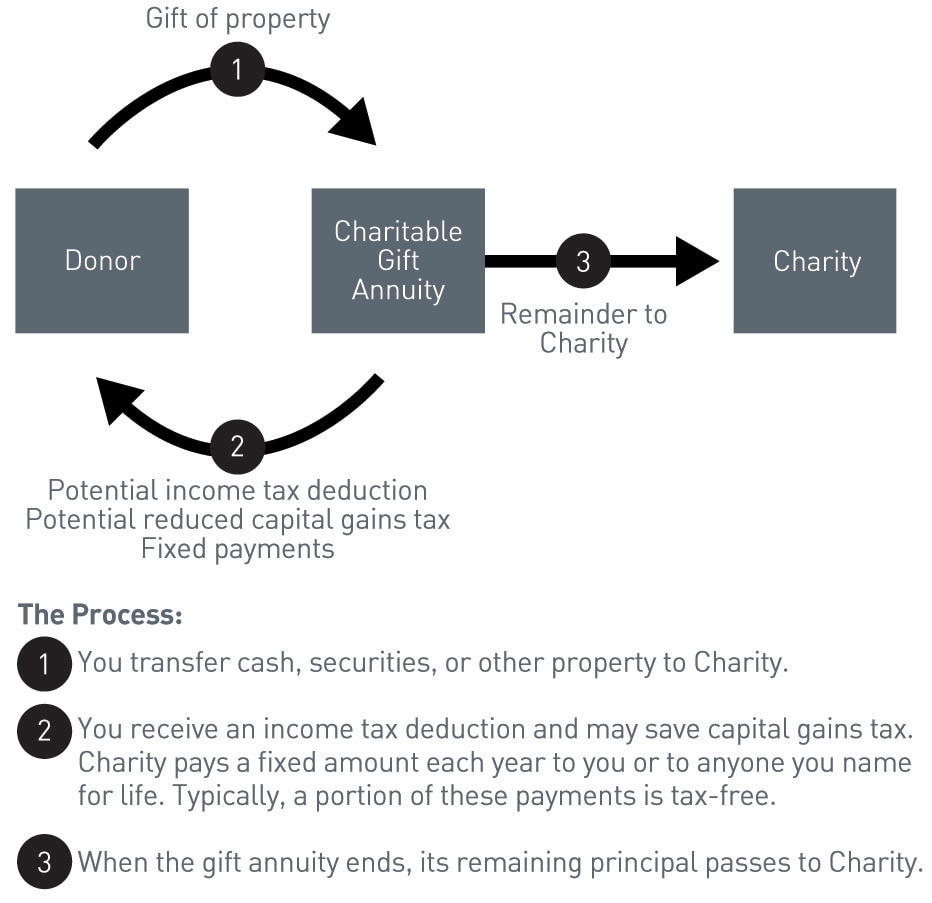

The modern forms of planned gifts. A charitable gift annuity is a gift vehicle that falls in the category of planned giving. The income tax charitable deduction for a gift annuity is less than the amount of the gift donated.

They fund a 25000 charitable gift annuity with appreciated stock that they originally purchased for 10000. When you create a charitable lead trust you can generally take a charitable income tax deduction equal to the present value of the payments to be made to charity. It involves a contract between a donor and a charity whereby the.

A charitable lead annuity trust is a perfect instrument to make a generous gift to demo while reducing or eliminating estate and gift taxes. The deduction is calculated by taking the full gift amount and. It will pay her 800000 a year or 40 a year for the rest of her life.

The charitable donation tax deduction is limited to the amount contributed to the annuity in excess of its present value as calculated using Internal Revenue Service IRS. If it is made at the end of the donors life it qualifies for an estate-tax charitable. She has 2000000 to invest in the annuity.

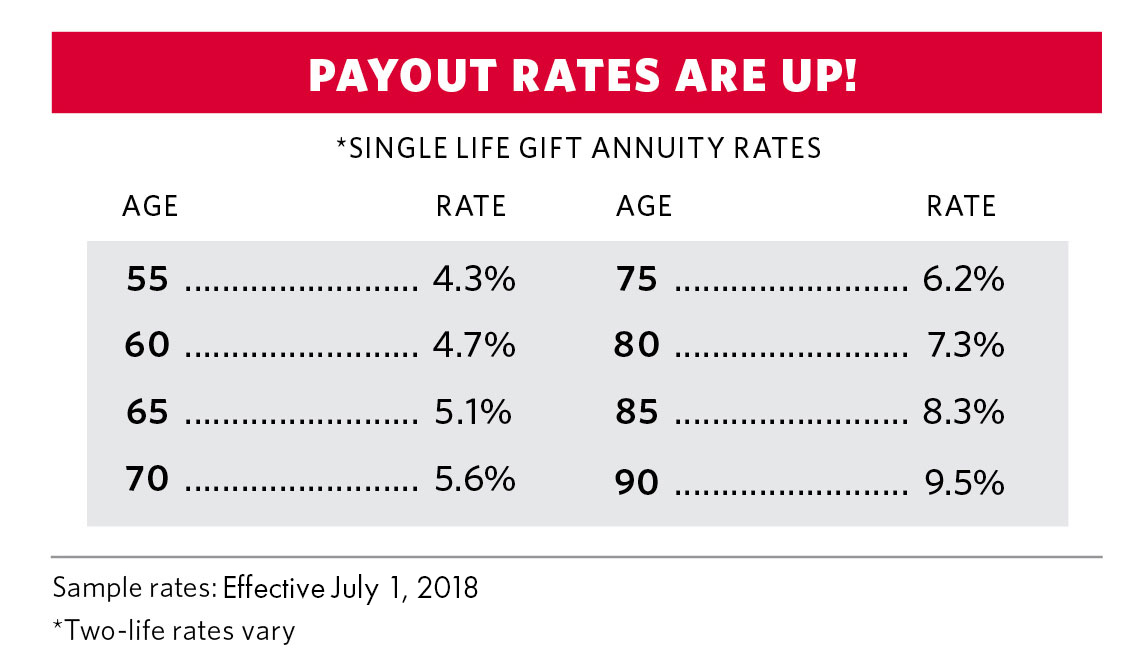

For 177 years 189551 of their annual annuity payments will be tax-free 3355050 177 189551. Generally you may deduct up to 50 percent of. At her age she will receive payments fixed for life at 58.

Again this is only a ballpark example and there are a few moving parts. That makes sense when you consider only part of the gift annuity is a gift to. When you donate you.

If a gift is made during the lifetime of the donor it qualifies for income-tax and gift-tax charitable deductions. The deduction amount is based on several variables. In addition to the income stream annuitants may also be eligible to take a tax.

The annuitants monthly payment is. Up to 25 cash back Charitable gift annuities have some tax advantages you cant get with other investments or methods of donation. Deductions identical to those afforded by charitable remainder annuity trusts but much lower amounts.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. This income tax deduction is equal to the amount of the. Butler who is 75 years old establishes a 25000 gift annuity for the eventual benefit of The Metropolitan Museum of Art.

You can expect a tax deduction of 5285932 after subtracting the present value of the charitable gift annuity payments from what you paid for the gift annuity. Therefore as the donor of a charitable gift annuity you are only eligible for a partial charitable tax deduction. Theyre also eligible for a federal income tax charitable deduction of 10217.

With a charitable gift annuity you have the potential to take a partial income tax deduction when you fund the annuity. Jones also desires to make a gift to her favorite charity. The initial investment may be as little as 5000.

The remaining part of their annual annuity payments. Minimum gifts for establishing a charitable gift annuity may be as low as 5000 but are often much larger.

What Is A Charitable Gift Annuity Fidelity Charitable

Charitable Gift Annuity Support Desales Desales High School

Turn Your Generosity Into Lifetime Income National Society Daughters Of The American Revolution

Charitable Gift Annuities The University Of Chicago Campaign Inquiry And Impact

Charitable Gift Annuity National Gift Annuity Foundation

Cal State East Bay Educational Foundation How You Can Give Gift Annuity

Charitable Gift Annuities Giving To Duke

Gift Annuities Wheaton College Il

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuity Flexible Harper College Educational Foundation

Gift Annuity Payout Rates Are Increasing

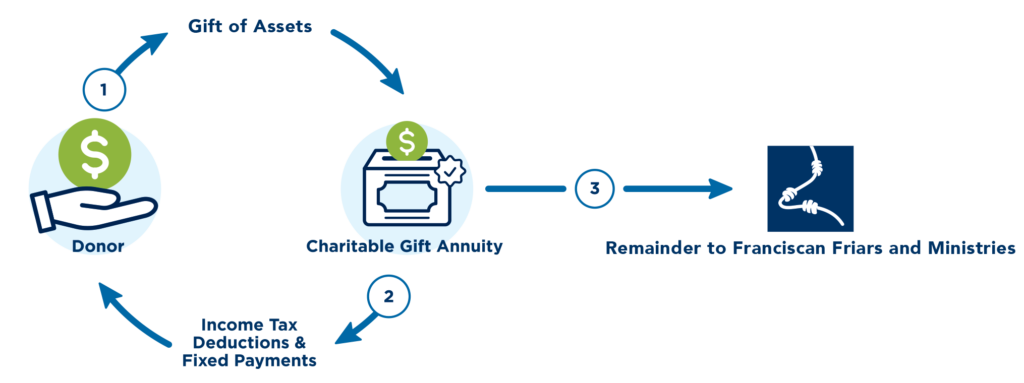

Franciscan Gift Annuities Other Life Income Plans Conventual Franciscan Friars

Key Differences Between Charitable Gift Annuities And Endowments Pnc Insights

Charitable Gift Annuity Texas A M Foundation

Charitable Gift Annuities Natural Resources Defense Council

Charitable Gift Annuity Wise Healthy Aging

Planned Giving Charitable Annuities Trusts Princeton Theological Seminary

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust